unlocking the secrets of cryptocurrency: identifying reveral patterns for better trading outcomes

The world of cryptocurrency has exploded in recent years, with prices skyrocketing and plummeting in a matter of hours. While many traders are still learning the ropes, one key strategy to success in identifying reveral patterns – or areas where price is likely to reverse direction. In this article, we’ll delve into the world of technical analysis and explore how to identify these crucial patterns.

What are reversal patterns?

Reversal patterns are specific price movements that indicate a potential shift in market direction. They can be identified by analyzing the relationship between price and momentum indicators, as well as other technical markers such as chart shapes and trend lines.

There are severe types of reveral patterns to watch out for, including:

- Bullish reversals : When price begins to rise after a decline, it’s often a sign that buyers have taken control.

- bearish reversals : conversely, when price falls after an uptrend, it may signal selling pressure.

- Head and shoulders reversal : A classic pattern of a head forming at the top or shoulders indicating impending reveral.

how to identify reversal patterns

To Develop your Skills in Identifying Revsal Patterns, Follow These Steps:

- Choose your charting platform : Select a reliable charting platform that provides accurate and up-to-date data.

- Familiarize yourself with technical indicators : undersand the basics of momentum indicators such as RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), and Bollinger Bands.

- Analyze chart Shapes : Study chart shapes to identify potential reveral patterns, including wedges, triangles, and triangles with a lower high.

- Look for Trend Lines and Support/Resistance : Identify Trend Lines and Support/Resistance Levels to Gauge Price Behavior.

Techniques for identifying reversal patterns

Here are some advanced techniques to help you refine your skills:

- Use Fibonacci retracement levels : Apply Fibonacci retracement levels to identify potential reversal points.

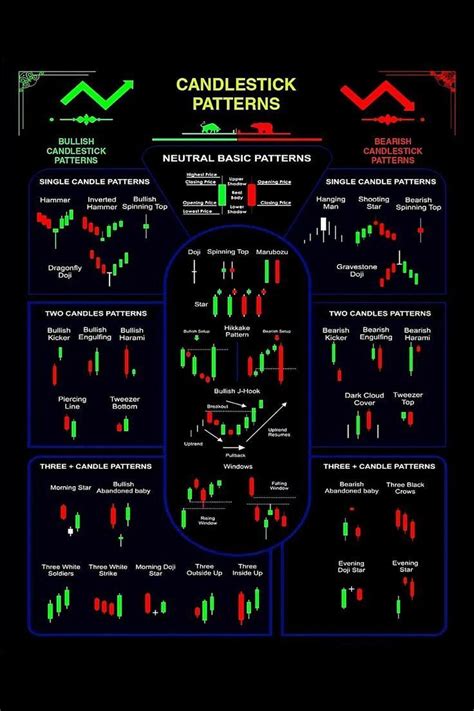

- Identify candlestick patterns

: Recognize candlestick patterns such as doji, hammer, and shooting star to anticipate price reversals.

- Look for overbought/overbills : Identify overbought or oversold conditions in the market, which can precede a reveral.

Real-World Examples

Let’s examine some real-world examples of successful traders who have identified reveral patterns:

* Mark Zuckerberg’s Facebook IPO (2012)

: Mark Zuckerberg’s Facebook Went from $ 34 to $ 46.8 Per Share Before reverse and rising to $ 230.5.

* Tesla’s stock reveral (2011-2014) : Tesla’s Stock Price Fell from $ 200 to $ 33.7 Per Share, then reverse and rose to $ 246.2.

Conclusion

Identifying reveral patterns is a critical skill for traders looking to succeed in the world of cryptocurrency. By mastering technical analysis and chart reading techniques, you’ll be better equipped to anticipate price reversals and make informed trading decisions. Remember, Practice Makes Perfect, so keep honing your skills by analyzing Real-World Examples and refining your strategy.

tips for beginners

- Start with a Solid Foundation : Familiarize yourself with Basic Technical Indicators and Chart Reading Techniques.

- Practice on demo accounts : use demo accounts to hone your trading skills without risking real money.

- Stay patient and disciplined : reveral patterns can be unpredictable, so it’s essential to maintain a long-term perspective.

With dedication and practice, you’ll become proficient in identifying reveral patterns and increase your chances of successful trades in the world of cryptocurrency.