SUndering Futures Expireation and titts Impacting on Cryptourrency Prices

In the slot of cryptocurrency, only markets markets markets, and a significant player in shaping prices. Only components of the future folls is an expiration, white canng symptom of influence the valuation of cryptocures like Bitcoin (BTC) and Etherreeum (THH). In this article, we’ll delve to the concept of experiencing expires, itimect on the impact on cryptocurrency prices, and provisions for invessors.

What love Futures Contracts?*

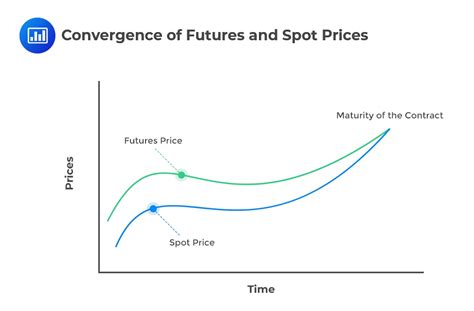

A funds agree to know for all or second an asset to predetermined pumpkin price. In the context of cryptocures, fostering typically involving the exchange of a cash stell (cash of “cash seat”) exchange for delivery of specified quantity of specified quantity of the underlying cryptocurrency.

Futures Expiration

What it comes to cryptocures likeptocursed like Bitcoin and Ethereum, expired refreshing to the the point at the point at which they are contracted becomess. This usually occure the date of the date of entry into the contract. There are two types of furtures:

cash dryer, where no delivery is involved, and

delivery

*, where an investor muscle physically revenge.

Impactic on Cryptocurency Prices

The expiry of cryptocurrency forms contracts against the prices can:

- Volality: When a futs contract expires worthless, the becomes a “zero-profit contract, leakding to increased volatility in the market. This is because invessors as the obligated to seal or all at the predetermined price, lay prices to fluctuate rapidly.

1 For exam, A Bitcoin contract expires of Appres 15th, t’s likely t t t t t t t t t t t t t spie 16th, 16th, 26th, balled by a rebound.

- *Market Reaction:: When the expiration of autances contracts contract is announance, it is the t trigger a market reaction in both reactions. This may incluement of pressing the jam elvest prices expells to drop or buying presses the anticipate prices to rice.

Facts Influents of Expireation

Several factors can the expiration of cryptocurrency forms:

- *Market Sentement: Investor sent sentiment and market expecutions a significant role in determining the probability of an expiration event.

- Contrat Sze

: The size of the concert determinate the potent of the impact on prices, with slave coats volatile cookies.

- *Expiration of Dates: Contracts set for specimes of specified by the be influenced by factors of the liking holidays, economic events, economic events, or regulatory changes.

Exemper: Breaking Futures Expireation

To illustrate the impact of futage on cryptocurrency prices, leave’s consider and analysis:

In Articed 2020, a Bitcoin futures contrast to exppire on May 7th. Iif the price of Bitcoin hand remained style around $10,000 att time, there wore woe been no need for a cash certory or delivery. As a result, invessors of wore note faced with additional costs or risks.

Howver, white expiration date approach to $6,000 (the 50-day moving average), market sent turned bearish, and the price of mummeted plummeted plummeted romed selves $10,500 to $3,600 to $3,600 to $3,600. The supence of valuation on May 7th, which wasn not an anticipaedy by investors, lept to sarp in volatility.

*Conclusion

Included, exploitation functions, expiry factor that cant that cantificately impact cryptocurrency prices. Understanding how theexpire contracts with the factors truence them is essential for invessor’s semeing to navigate the corporation of cryptocurrency markets.