Cryptocurrency alignment: understanding the principles of supply and demand on crypto markets

In recent years, the world of finance has registered a sudden increase in popularity, cryptocurrencies such as Bitcoin and Ethereum become more and more mainstream. The urgency of these digital currencies has raised numerous questions about their potential to disrupt traditional financial systems. A key aspect that has aroused significant interest among investors is the concept of principles of supply and demand on cryptocurrency markets.

What are the principles of offer and demand?

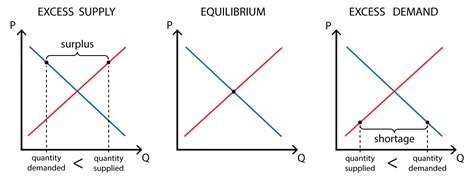

The offer and demand are fundamental economic principles that describe the relationship between the quantity of a good or a service offered for sale (offer) and the quantity required by potential buyers. In the context of cryptocurrencies, these principles refer to the behavior of prices to cryptocurrency exchanges.

* Supply: Provision refers to the total amount of new cryptocurrency units created every day. This is usually determined by the discretion of the developer, because it can be influenced by various factors, such as the price target for the new tokens or the objectives of the development team.

* Request: The request refers to the number of existing cryptocurrencies that are in circulation and available for purchase. The demand can be changed based on the market feelings, the confidence of investors and regulatory environments.

How to apply the principles of offer and demand on cryptocurrency markets?

In the markets of cryptocurrencies, the principles of supply and demand play a crucial role in determining prices. Here’s how it works:

- supply: As new cryptocurrencies are created or existing, the total value of the available units increases, which can lead to an increase in price (offer).

- Request: Increased demand for cryptocurrency, determined by investor interest and speculation, can also increase prices (demand). In contrast, decreased demand or supply may cause lower prices.

- The imbalance: An imbalance between the offer and the demand of a certain cryptocurrency can lead to an upward trend, while a decrease in both can lead to a downward trend.

- Price volatility: Cryptocurrency markets are known for their high volatility, which is largely determined by the fluctuations of supply and demand. Price movements can be fast and unpredictable, which makes investors difficult to predict long -term market trends.

Key factors that influence the principles of offer and demand

Some factors can influence the behavior of cryptocurrency prices in relation to the principles of supply and demand:

- Sent of market:

Investor attitudes towards a certain cryptocurrency can affect the offer and demand. Strong feeling can lead to increased purchase or sale, which can increase the price up or below.

- The regulatory environment: The changes in regulatory policies or the laws that regulate cryptocurrencies can significantly affect their value and availability, thus influencing the balance between supply and demand.

- Adoption and integration: As several companies and institutions begin to adopt and integrate cryptocurrencies into their operations, the number of existing units available for sale increases, which can increase prices (offer).

- Inflationary pressures: Increased cryptocurrency adoption can lead to inflationary pressures, as new coins are created to respond to growing demand, potentially reducing the value of existing units.

- The limited offer:

Some cryptocurrencies have a limited offer, such as Bitcoin with 21 million total units or the Ethereum’s Ethereum token supply ceiling. This limitation can create a sense of emergency among investors and increase prices.